USD/JPY Rises Amid Hopes for a Soft Landing of the U.S. Economy【November 16, 2023】

November 16, 2023

Markets Analysis

目次

Fundamental Analysis

- The UK Consumer Price Index falls short of expectations, GBP/USD sees a slight decline

- The U.S.-China Summit takes place, both countries express a desire to avoid military conflict

- U.S. retail sales are not as weak as expected, raising hopes for a soft landing

USDJPY Technical Analysis

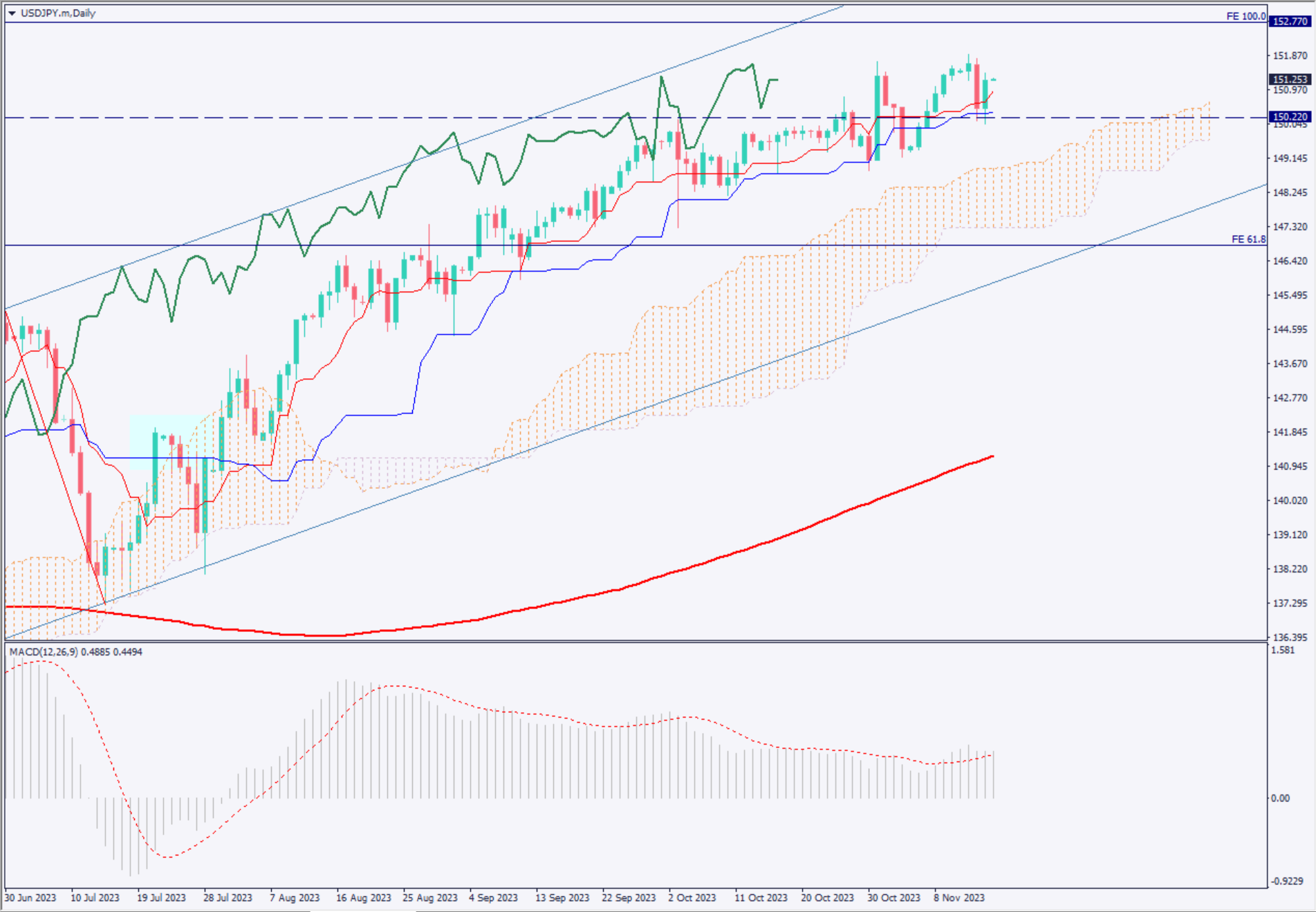

Analyzing the daily chart of USD/JPY. Despite a decrease in the U.S. Producer Price Index, strong retail sales suggest robust consumer sentiment ahead of the year-end shopping season in the U.S. There is also caution over excessive expectations for a U.S. rate cut next year.

While the dollar’s rise is pausing, the fundamental situation remains unchanged, and the yen continues to be the weakest. Currently, USD/JPY is around 151.25 JPY, with the MACD histogram showing a slight upward trend. The Ichimoku Kinko Hyo shows an upward trend without breaking the baseline.

The candlestick formed today may add momentum to the market direction. Going forward, surpassing 151.78 JPY will be a critical point.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of USD/JPY. A double bottom formation is seen around 150.22 JPY, indicating strong support below 150 JPY. A significant effort is required to break below this level.

Currently, the market sentiment is heavily biased towards selling positions at 74%, which may lead to a sharp rise targeting stop losses. However, the possibility of currency intervention cannot be completely ruled out.

As a day trading strategy, consider buying on a dip at 150.89 JPY, setting a target profit at 151.70 JPY, and a stop-loss line at 150.10 JPY.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

150.22 JPY – Major support zone

Market Sentiment

USDJPY Sell: 74% Buy: 26%

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Employment Statistics | 9:30 |

| U.S. Philadelphia Fed Manufacturing Index | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.