USD/JPY Falls as U.S. Labor Market Shrinks, Raising Speculation of an End to Interest Rate Hikes【November 17, 2023】

November 17, 2023

Markets Analysis

目次

Fundamental Analysis

- The U.S.-China summit concludes, agreement on military-level dialogue but no resolution to conflicts

- U.S. unemployment insurance claims increase, indicating a slight contraction in the labor market

- Crude oil prices drop significantly, breaking the USD 75 support line, falling into the USD 72 range

USDJPY Technical Analysis

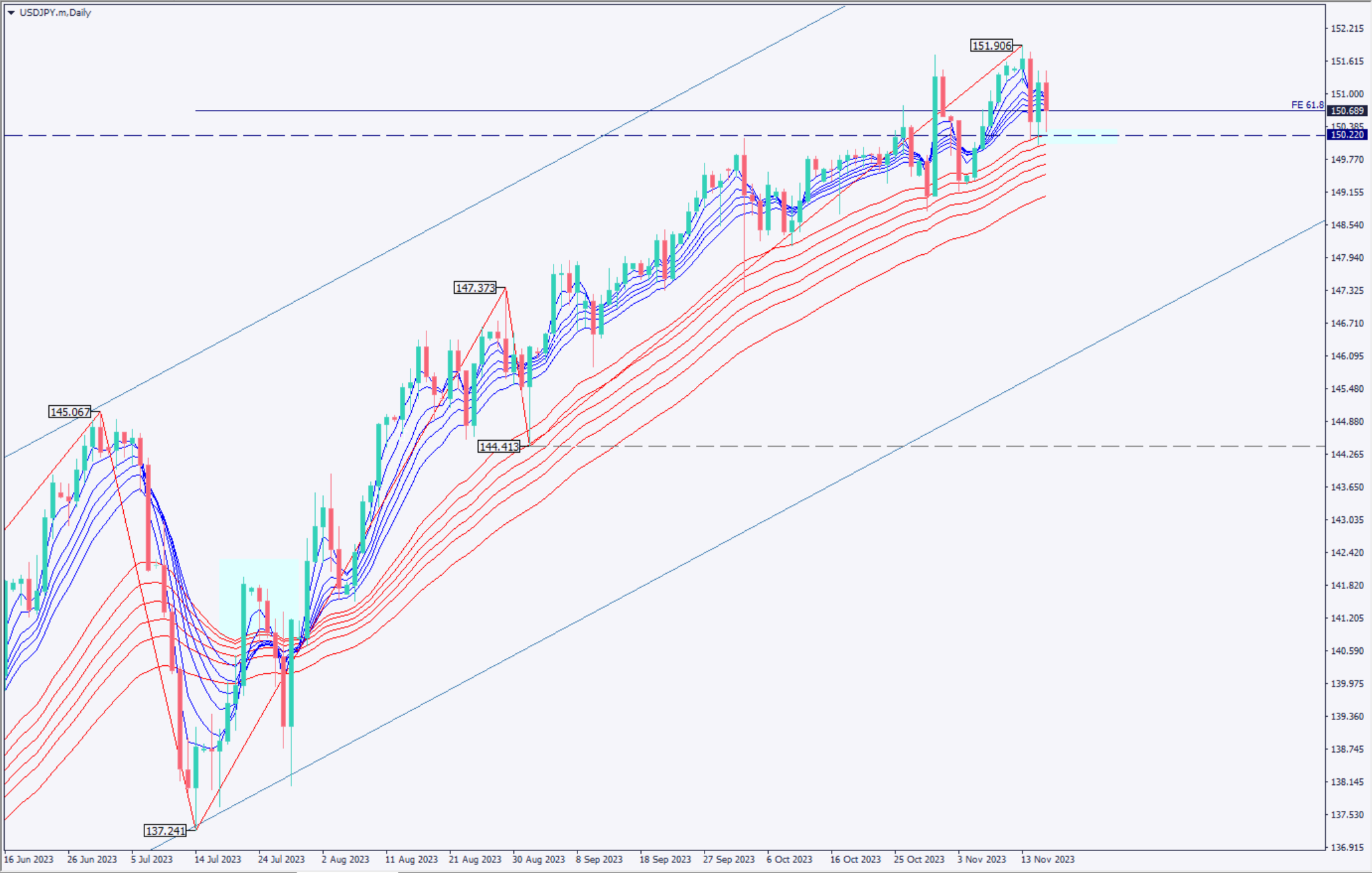

Analyzing the daily chart of the USD/JPY pair. Currently, the price has fallen to the mid-150 JPY range, reflecting the increase in job seekers due to the rise in U.S. unemployment insurance claims. This has lowered the likelihood of further interest rate hikes, leading to a rise in stock prices and a cheaper dollar.

The market is currently enveloped by the high and low of a large bearish candle formed three days ago, requiring caution for strong future movements. A drop below 150.22 JPY could accelerate the yen’s strength. The Ichimoku Kinko Hyo suggests a potential market peak, with prices below the Conversion Line. The expected U.S. interest rate cut could lead to a narrowing interest rate differential, potentially strengthening the yen.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of the USD/JPY pair. Currently, a strong downward trend is visible, aiming towards 150.220 JPY. Today’s pivot point is around 150.80 JPY, with a strong resistance above 150.75 JPY.

The RSI stands at 45, and the MACD histogram is beginning to form a valley. Yesterday’s low was 150.285 JPY, which did not break below 150.220 JPY. Considering the daily chart pattern, there is a possibility of retesting the low.

For day trading, consider selling on a rebound near 150.75 JPY. Set the take-profit at 150.22 JPY and the stop-loss at 151.20 JPY.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

151.48 JPY: Major resistance zone

150.22 JPY: Major support zone

Market Sentiment

USDJPY: 66% Sell, 33% Buy

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| UK Retail Sales | 16:00 |

| EU Consumer Price Index | 19:00 |

| U.S. Building Permits | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.